flow-through entity tax form

Streamlined Document Workflows for Any Industry. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity.

This legislation was passed as a.

. This disconnect between receipt of cash and. For further questions please contact the Business Taxes. The deduction limits apply both to the business entity and the owner.

However the late filing of 2021 FTE returns will be. Income that is or is deemed to be effectively connected with the conduct of a. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

The governor has signed legislation allowing eligible entities to opt in to the New York City pass-through entity tax for 2022. Find Forms for Your Industry in Minutes. Each entity calculates its 179 expenses and applies the limit.

Ad State-specific Legal Forms Form Packages for Consulting Services. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain. New York City Pass-through Entity Tax.

The following are all pass-through entities. This rule applies for purposes of NRA withholding and for Form 1099 reporting and backup withholding. A business owned and operated by a single individual.

There are three main types of flow-through entities. Types of flow-through entities. Governor Whitmer signed HB.

MSC II filed a petition under Chapter 11 of the Bankruptcy Code after which BDI. 653001210094 Department of Taxation and Finance IT-653 Pass-Through Entity Tax Credit Tax Law Section 606kkk 1Add column C amounts see instructions. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the. A QSub like an S corporation is a flow-through entity for federal income tax purposes.

The expenses subject to the limit are then passed. 1 00 Schedule A Pass. The Michigan Department of Treasury recently issued templates to assist taxpayers with filing their 2021 Michigan Flow-Through Entity FTE Tax Returns.

Branches for United States Tax Withholding and. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes.

5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

What Is A Pass Through Business How Is It Taxed Tax Foundation

Recent Ftb Clarifications On Pass Through Entity Tax Ab 150 Roger Rossmeisl Cpa

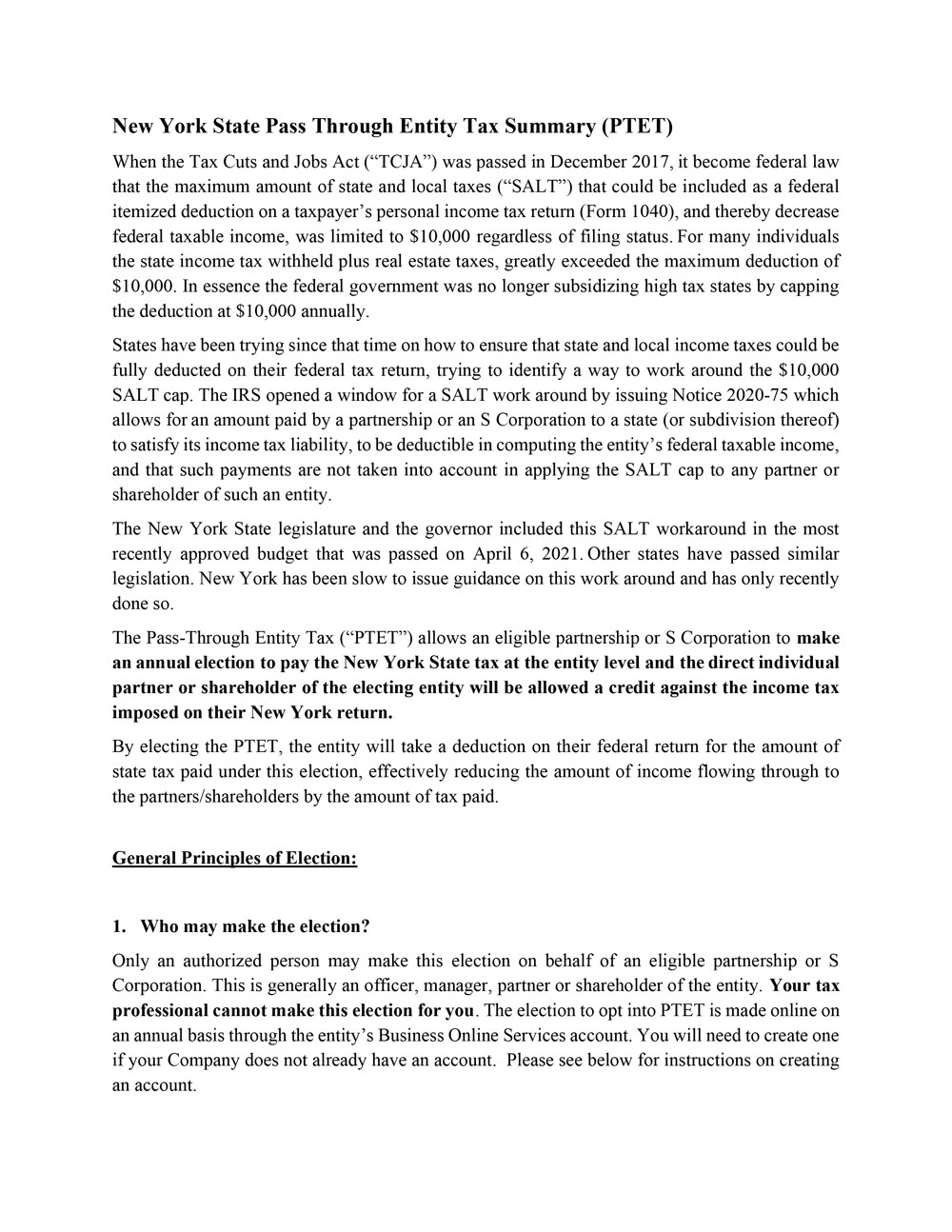

New York State Pass Through Entity Tax Welker Mojsej Delvecchio

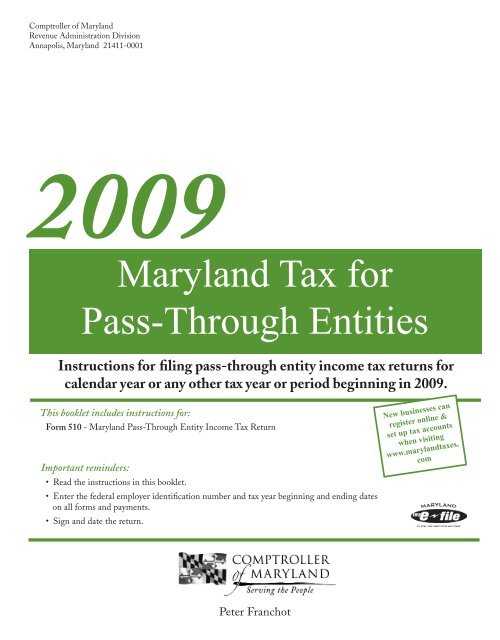

Maryland Tax For Pass Through Entities The Comptroller Of Maryland

Nys Pass Through Entity Tax Explained Youtube

Pass Through Entity Tax 101 Baker Tilly

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal

Form 84 105 Pass Through Entity Tax Return

Pass Through Entity Tax Akmcpa

New Schedules K 2 K 3 Affecting All Flow Through Entity Tax Returns Aafcpas

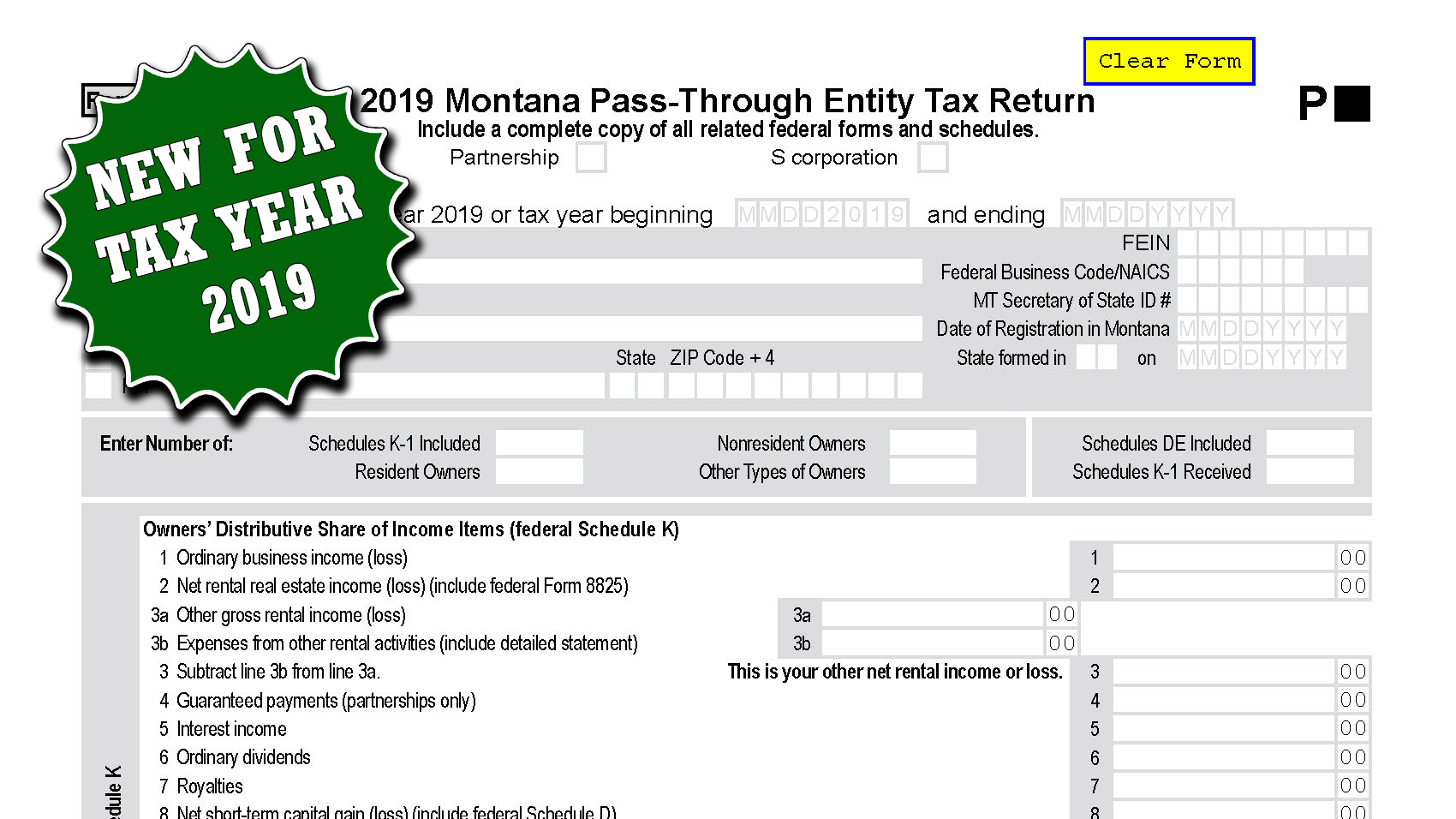

New For Tax Year 2019 Montana Pass Through Entity Tax Return Form Pte Montana Department Of Revenue

Free Form 106 Income Tax Return For Pass Through Entities And Composite Filing For Nonresidents Booklet Free Legal Forms Laws Com

Considerations For California S Pass Through Entity Tax Deloitte Us

What Is A Pass Through Entity Formations

Picpa Committee To Vote On Pass Through Entity Tax House Bill 1709 Wilke Associates Cpas

What Is A Passthrough Entity Universal Cpa Review

Oregon Pass Through Entity Elective Tax Kernutt Stokes

New York State Pass Through Entity Tax Sciarabba Walker Co Llp